Understanding tax brackets is an essential part of managing your finances, especially when it comes to filing your taxes each year. In 2023, the U.S. tax system continues to operate on a progressive scale, meaning the more you earn, the higher the percentage of your income is taxed. Whether you’re a single filer, married couple, or head of household, knowing where your income falls within the tax brackets 2023 is crucial to estimating your tax liability and finding ways to minimize your taxes.

In this guide, we’ll walk you through the tax brackets for 2023, how they work, and what you can do to make the most of them.

What Are Tax Brackets?

Tax brackets refer to the range of income that is taxed at a specific rate. The U.S. uses a progressive tax system, meaning that different portions of your income are taxed at different rates. As your income increases, the amount you pay in taxes also increases, but only on the income within each tax bracket.

For example, if you’re a single filer and earn $50,000 in 2023, part of your income will be taxed at the 12% rate, while another portion will be taxed at the 22% rate. You don’t pay the same tax rate on all your income—only on the portion that falls within each tax bracket.

2023 Tax Brackets: Breakdown by Filing Status

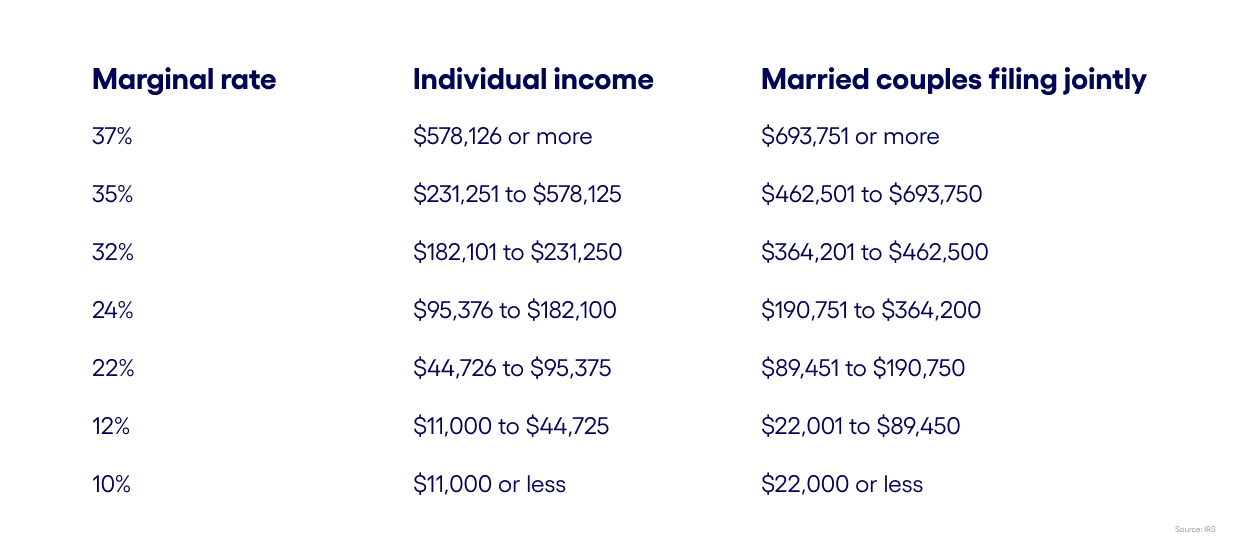

The IRS has adjusted the tax brackets for inflation, which means the income thresholds for each bracket have increased slightly in 2023. Here are the tax brackets for the different filing statuses:

Single Filers:

- 10%: Up to $11,000

- 12%: $11,001 to $44,725

- 22%: $44,726 to $95,375

- 24%: $95,376 to $182,100

- 32%: $182,101 to $231,250

- 35%: $231,251 to $578,100

- 37%: Over $578,100

Married Filing Jointly:

- 10%: Up to $22,000

- 12%: $22,001 to $89,450

- 22%: $89,451 to $190,750

- 24%: $190,751 to $364,200

- 32%: $364,201 to $462,500

- 35%: $462,501 to $693,750

- 37%: Over $693,750

Head of Household:

- 10%: Up to $15,700

- 12%: $15,701 to $59,850

- 22%: $59,851 to $95,350

- 24%: $95,351 to $182,100

- 32%: $182,101 to $231,250

- 35%: $231,251 to $578,100

- 37%: Over $578,100

How Tax Brackets 2023 Affect You

The way tax brackets work is that the tax rate applies to portions of your income, not your entire income. This means that you might fall into a higher tax bracket, but only the income within that bracket will be taxed at the higher rate. Let’s look at a few examples to make it clearer:

Example 1: Single Filer Earning $50,000

- 10% tax on the first $11,000 = $1,100

- 12% tax on the income between $11,001 and $44,725 = $4,047 (33,725 x 12%)

- 22% tax on the income between $44,726 and $50,000 = $1,155 (5,275 x 22%)

In this case, your total tax would be the sum of all those amounts, which would be around $6,302. You wouldn’t be taxed 22% on your full $50,000 income—only on the amount over $44,725.

Example 2: Married Couple Filing Jointly Earning $120,000

- 10% tax on the first $22,000 = $2,200

- 12% tax on the income between $22,001 and $89,450 = $8,094 (67,450 x 12%)

- 22% tax on the income between $89,451 and $120,000 = $6,726 (30,550 x 22%)

Your total tax liability would be the sum of these amounts, or approximately $17,020.

How to Minimize Your Taxes in 2023

There are several strategies you can use to minimize your taxes in 2023, even as you navigate the tax brackets. Here are a few key methods to consider:

- Maximize Your Retirement Contributions: Contributing to retirement accounts like a 401(k) or IRA can reduce your taxable income, potentially lowering the amount of income that falls into the higher tax brackets. In 2023, you can contribute up to $22,500 to a 401(k) and $6,500 to an IRA (with catch-up contributions available for those 50 and older).

- Take Advantage of Tax Deductions: Deductions such as the standard deduction (which is $13,850 for single filers, $27,700 for married couples filing jointly in 2023) can lower your taxable income. Other deductions may include mortgage interest, student loan interest, and medical expenses if you qualify.

- Consider Tax Credits: Tax credits directly reduce the amount of tax you owe. Examples include the Child Tax Credit, the Earned Income Tax Credit (EITC), and education-related credits like the American Opportunity Credit.

- Tax-Loss Harvesting: If you have investments, tax-loss harvesting allows you to offset gains by selling investments that have lost value. This can lower your taxable income and help you reduce the amount of your income taxed at the higher tax brackets.

- Stay Informed About Changes in Tax Laws: Tax laws can change from year to year, and staying up-to-date on changes, like the inflation-adjusted tax brackets 2023, is essential for minimizing your tax burden. Consulting with a tax professional or using tax preparation software can help you navigate any new updates.

Conclusion

Understanding tax brackets 2023 and how they affect your taxes is essential to managing your finances effectively. By knowing where your income falls within the tax brackets and utilizing tax-saving strategies, you can reduce your tax liability and keep more of your hard-earned money. Whether you’re filing as a single individual, married couple, or head of household, being aware of your tax bracket helps you make informed decisions about your financial future.

Remember that tax brackets are only part of the picture—deductions, credits, and long-term planning also play an essential role in lowering your taxes. As tax season approaches, take the time to review your financial situation and consider how you can minimize your taxes in 2023