In today’s fast-paced forex industry, brokers must be agile, efficient, and client-centric to stay competitive. As trading volumes surge and client expectations rise, leveraging the right technology becomes essential. One such innovation that has transformed brokerage operations is the integration of Forex CRM MT5. This powerful combination of a customer relationship management system and the MetaTrader 5 platform enhances operational efficiency, supports client retention, and automates multiple aspects of trading and administrative processes.

Understanding Forex CRM MT5

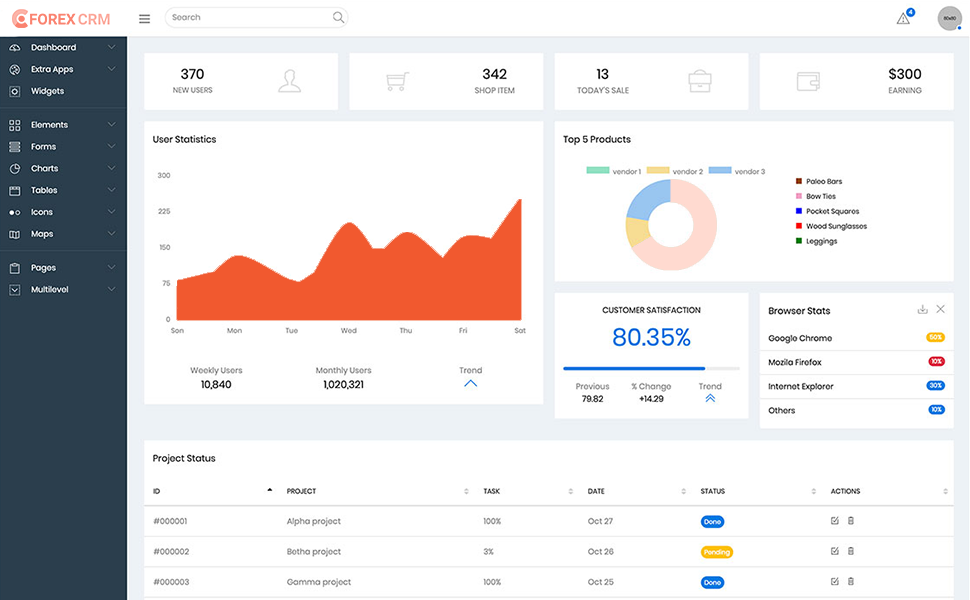

Forex CRM MT5 refers to the integration of a forex-specific CRM system with the MetaTrader 5 trading platform. MT5, known for its multi-asset capabilities, is widely adopted by forex brokers due to its flexibility, fast execution, and analytical tools. When combined with a robust CRM system, brokers gain a unified platform for managing leads, onboarding clients, executing trades, handling support tickets, monitoring compliance, and more.

The integration goes beyond simple data sharing. It creates a seamless environment where sales, support, compliance, and trading departments work in sync. This synergy ensures traders enjoy a frictionless experience, from account registration to active trading, while brokers benefit from centralized data and streamlined workflows.

Enhancing Client Onboarding and KYC Processes

One of the core benefits of Forex CRM MT5 lies in the automation of onboarding procedures. New traders can register accounts via branded portals, submit verification documents, and complete KYC checks automatically. The CRM system communicates directly with MT5 to create trading accounts once verification is successful.

This rapid and compliant onboarding reduces time-to-trade and enhances the client experience. Automated KYC workflows help brokers meet regulatory requirements without manual intervention, reducing errors and ensuring a smooth start for new clients.

Streamlining Trade Management

Trade execution and monitoring are central to any brokerage. Forex CRM MT5 offers real-time access to trade data, allowing account managers and support staff to assist clients effectively. CRM dashboards can pull trade history, open positions, P&L reports, and margin data from MT5, all in one place.

This centralized access enables faster client support, proactive risk monitoring, and improved service delivery. Brokers can use this insight to recommend relevant trading strategies, provide updates, and identify unusual trading patterns early—boosting transparency and trust with clients.

Automating Sales and Lead Management

Forex CRM MT5 is essential for sales teams managing high volumes of leads and clients. The CRM captures leads from multiple sources—landing pages, social media campaigns, affiliate networks—and assigns them to appropriate agents based on predefined rules or performance metrics.

Agents receive automated alerts and detailed client histories to personalize communication. Integration with MT5 means that agents can track when a lead becomes an active trader and trigger relevant workflows like welcome emails, bonus notifications, or upselling campaigns. Automation eliminates manual data entry, enabling teams to focus on closing deals and nurturing long-term relationships.

Improving Client Retention and Support

Customer support and retention are crucial for sustainable brokerage growth. With Forex CRM MT5, brokers can implement ticketing systems, live chat modules, and feedback mechanisms directly within the CRM. These tools help monitor client satisfaction, resolve issues swiftly, and follow up effectively.

The CRM’s access to MT5 data allows support teams to reference specific trades or account activities when addressing client concerns. This context-rich support builds client trust and reduces churn. Additionally, brokers can segment their client base and launch targeted loyalty campaigns, promotions, or educational webinars to increase engagement and retention.

Enhancing Compliance and Risk Management

Regulatory compliance and risk oversight are non-negotiable in the forex industry. Forex CRM MT5 plays a vital role in ensuring adherence to global regulations such as AML, GDPR, and ESMA guidelines. Automated reporting features allow brokers to generate compliance reports on deposits, withdrawals, client verification, and suspicious activity.

Risk management teams can also leverage CRM-MT5 integration to monitor leverage usage, margin calls, stop-outs, and exposure across accounts. Real-time alerts and historical analysis help mitigate operational and market risk, safeguarding both the brokerage and its clients.

Boosting Marketing Performance

Modern CRMs for forex brokers offer built-in marketing automation tools. With Forex CRM MT5, brokers can run personalized email campaigns, SMS alerts, and push notifications based on trading behavior. For instance, if a trader hasn’t logged in for a week, an automated re-engagement email can be triggered.

The system also tracks ROI from campaigns by connecting marketing data with trading activity on MT5. This enables brokers to understand which channels generate the most valuable clients and adjust their strategy accordingly. Moreover, affiliate tracking modules help manage partnerships and commissions, further optimizing marketing ROI.

Seamless Back-Office Integration

Back-office operations are often the backbone of a broker’s infrastructure. Forex CRM MT5 ensures that deposit and withdrawal processes, IB commission calculations, and reporting functions are all automated and error-free. Whether it’s processing client payouts or generating profit-and-loss reports, integration between the CRM and MT5 minimizes human error and delays.

Payment gateway integration is another key advantage. Clients can fund their trading accounts using various methods, and the CRM reflects those changes in real time within the MT5 account. This real-time flow of funds enhances transparency and reduces client complaints related to balance discrepancies.

Multi-Level IB and Partner Management

Referral programs and Introducing Broker (IB) structures are crucial in forex. Forex CRM MT5 enables brokers to manage multi-level IB networks with transparency. The system calculates and tracks commissions automatically, displays hierarchical structures, and provides performance analytics for each IB.

Partners can access branded dashboards to view their referrals, earnings, and marketing tools, encouraging active participation. Brokers benefit from scalable partner programs without manual calculations or reconciliation issues, thus expanding their reach efficiently.

Scalability and Customization

Every brokerage has unique workflows, regulatory obligations, and growth targets. Forex CRM MT5 systems are often modular and customizable, allowing firms to tailor features such as dashboards, user roles, notifications, and integration with third-party apps like email services, analytics tools, and liquidity providers.

As the business scales, the CRM can accommodate multiple brands, regional operations, languages, and currencies. This scalability ensures long-term value and eliminates the need to switch systems as the business grows.

Conclusion

Forex CRM MT5 has become an indispensable asset for brokers looking to streamline their trading processes and provide superior client service. From automated onboarding and trade monitoring to marketing automation and compliance, this integrated solution empowers brokers to scale faster, reduce operational overhead, and improve client satisfaction. As competition intensifies in the forex industry, adopting a robust Forex CRM MT5 platform may very well be the key differentiator between thriving and merely surviving.